The World Bank’s prediction that the Burmese economy would grow at some 8.2 percent this year, and a further eight percent leading into the 2016-17 fiscal year, has been slashed in the latest ‘Myanmar Economic Report’.

The revision has decreased the estimate by nearly two percent, with the new figure sitting at 6.5 percent, due largely to the devastating impact of widespread flooding and landslides in July and August that decimated nearly one million acres of rice crops. However the World Bank also warned that this figure was still subject to revision, as the full assessment of the economic impact of the flood is ongoing.

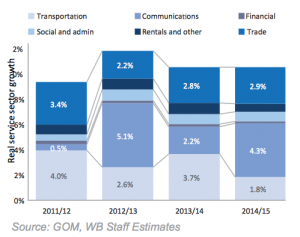

A still-expanding service sector was highlighted as a key driver factor in the country’s growth, with the transport industry still undergoing development, and telecommunication companies expanding their reach throughout the country. The service sector was additionally buoyed by a 35 percent increase in foreign arrivals, through both tourism and business channels.

Inflation was tipped as likely to increase to 11.3 percent, again due in large part to the supply pressures caused by floods, as well as depreciation in the kyat.

Sean Turnell, associate professor at the Business and Economics School in Macquarie University, said that the rising cost of living is becoming a “real problem”.

“[The 11.3 percent inflation rate] will be more than four times the regional average. To be fair to the government, some of this is coming from rising food prices brought about by the recent floods, but by no means all of it. Together with food price inflation, housing costs are rising sharply too. All of this suggests ordinary people are the biggest losers on this front.

“Not helping is the fact that ‘money printing’ continues to be the dominant way in which Burma’s fiscal deficits are financed,” he said.

[related]

Burma’s export trade has lagged in the 2014-15 period, with forestry products in particular slowing, due to a ban on the export of unprocessed logs from natural forests. Until the time of the ban in April 2014, raw logs accounted for some 90 percent of the forestry export industry. Gas export remained strong however, increasing by 43 percent in nominal terms and helping to offset the loss felt by declining forestry revenue, the World Bank said.

Between the New Year and August, a strong US dollar and stunted foreign investment led to depreciation in the exchange rate, the report said. Some analysts have pointed to the upcoming election, and possible government transition period, as contributing to foreign investment hesitation, which the World Bank stated would be imperative for advanced growth in the coming years.

The World Bank added that medium-term growth has remained strong despite tension from flooding, and as the rehabilitation effort continues, demand will grow for imported construction infrastructure, and would likely stymie agricultural exports for the same reason.

Heading into the future, the report advised that “strong growth will depend, among other things, on continued progress in macro-structural reforms such as strengthening the business environment, modernising the banking sector, and strengthening public debt management. Addressing short-term macroeconomic challenges will require continued efforts to maintain exchange rate flexibility as well as monetary and fiscal policy discipline.”

According to the World Bank, other Southeast Asian countries are expected to follow a similar pattern, due to an expected downturn in China and a hike in US interest rates.